What is Duty Drawback?

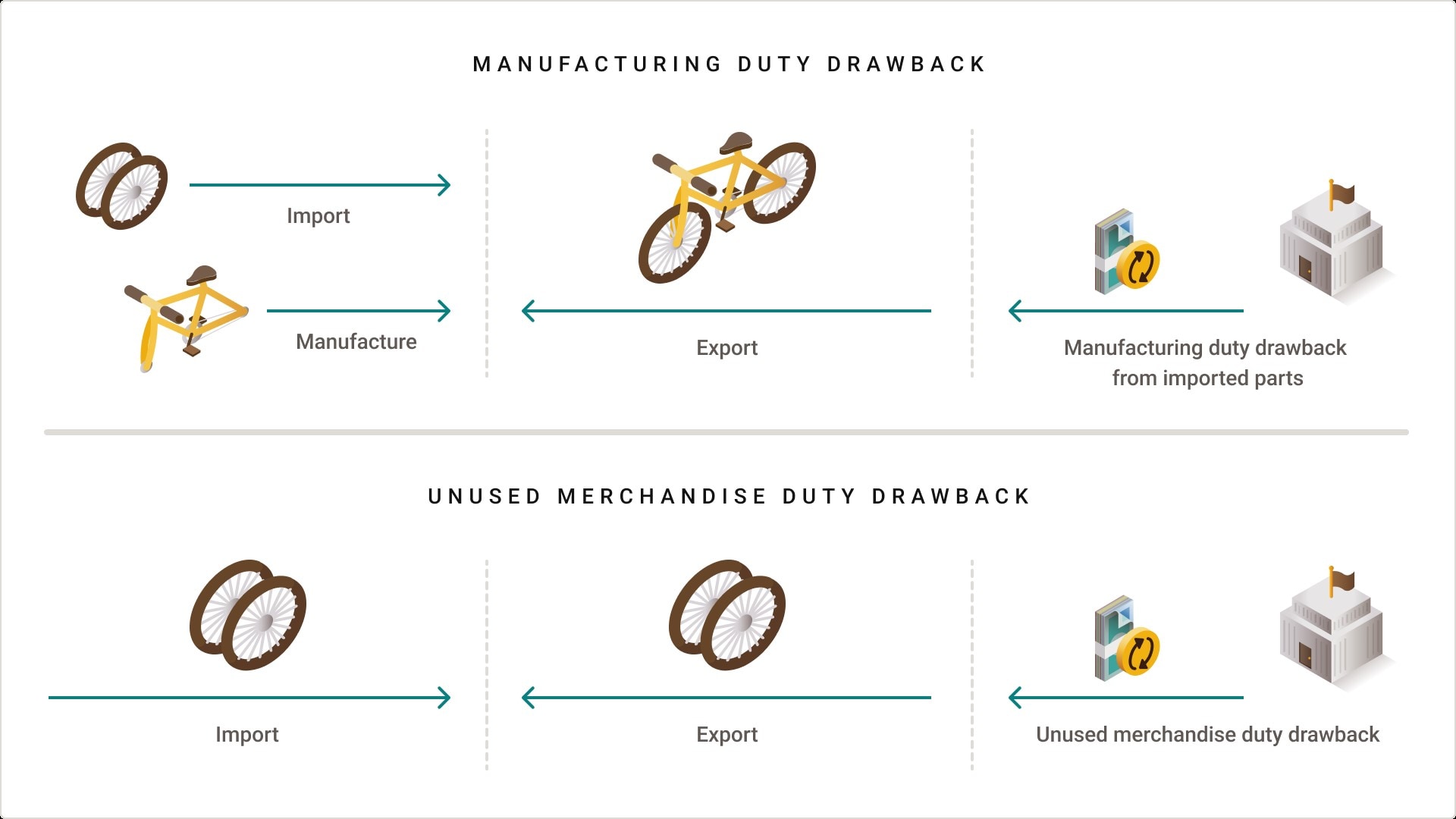

Duty Drawback is a refund of duties, fees and taxes paid on certain categories of goods imported into the US that are then exported from the US. Similar to how sales tax is refunded when you return an item to a store, you can claim a duty refund when you export an item that was previously imported.

The Duty Drawback Program was originally established by the Continental Congress back in 1789 with the initial purpose of encouraging manufacturing and exports. It has since evolved to include provisions to drawback law that covers more products and commodities.