An Overview

The ocean freight market has been in turmoil since the beginning of May, caused by many factors stretching capacity and raising rates to unexpected levels reminiscent of the pandemic era. As a result, an early peak season is emerging in the ocean freight market, surprising both NVOCC (Non-Vessel Operating Common Carrier) and direct BCO (Beneficial Cargo Owner) customers1. It's imperative for shippers and logistics providers to understand the factors impacting the global supply chain and how they can respond.

When is Ocean Peak Season Typically and What Occurs?

Ocean peak season typically occurs around August through October, driven by retailers stocking up for the holiday season. During this period, shipping volumes peak, leading to higher and sometimes volatile rates due to the increased demand for limited shipping capacity.

Why is Ocean Freight Peak Season Early?

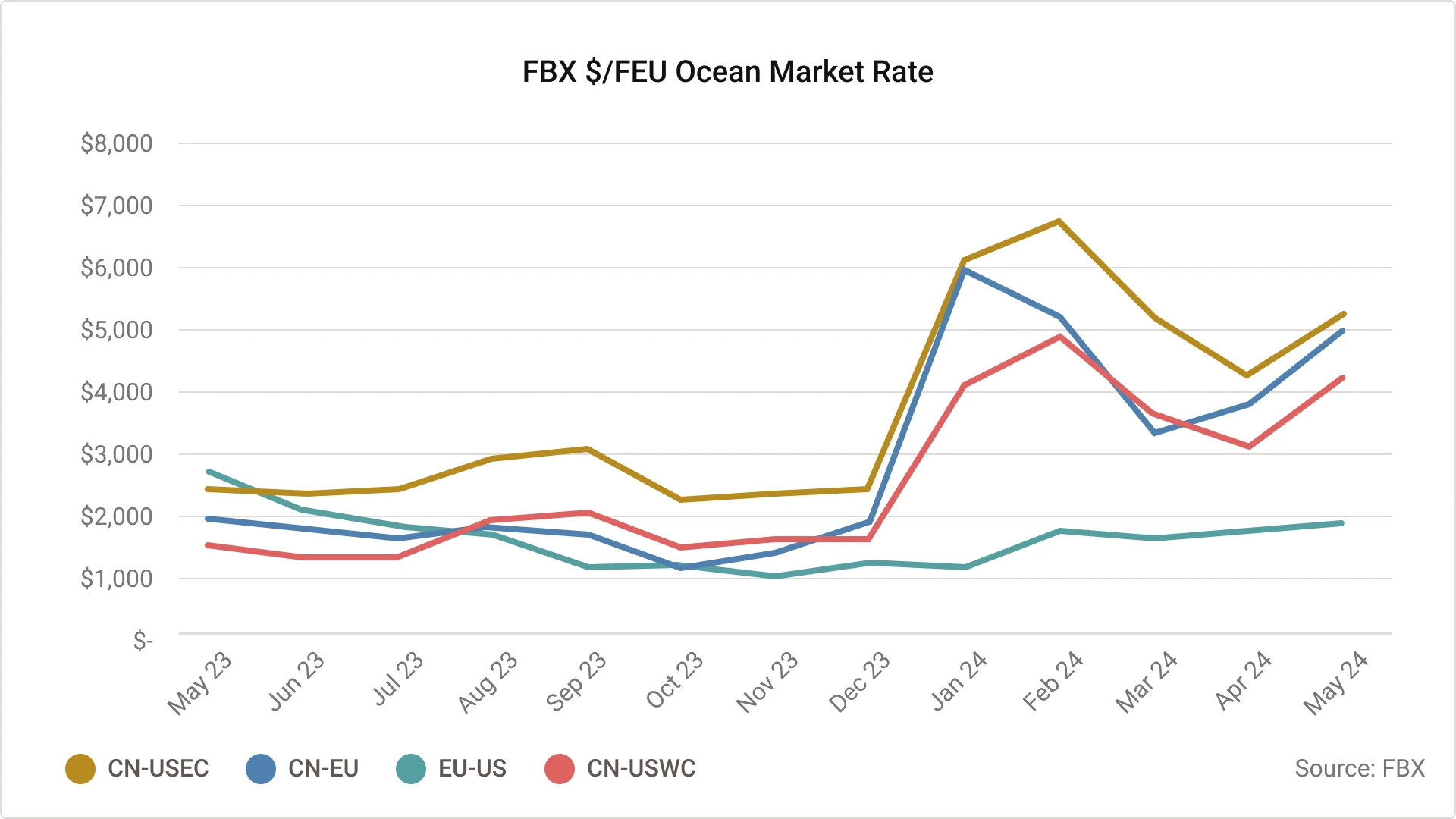

While rates have been higher since the end of 2023, they have been steadily declining in recent months. However, numerous factors from capacity fluctuations to overwhelming demand on select trade routes are accelerating the 2024 ocean peak season timetable.

Market drivers include:

- Red Sea Capacity Absorption: Although there have been significant new-build vessels entering the market, the ongoing disruptions in the Red Sea have absorbed a substantial portion of global shipping capacity. The ongoing conflict is forcing carriers to divert away from the Suez Canal to go down around the Cape of Good Hope on the southern tip of Africa. This removes capacity from the market by significantly extending transit time on each leg of a vessel's voyage. Overall, diversions are removing 9% of global capacity year-over-year2, while according to the latest Drewry Container Forecaster report, new-builds are only adding 8%, creating a persistent deficit that strains overall capacity., creating a persistent deficit that strains overall capacity. Read more about the Suez Canal Trade Disruptions.

- Unexpected Demand: Due to increased demand for eCommerce shipments, restocking of inventories, and other factors, Transpacific East Bound (TPEB) and Asia – Europe trade lanes are experiencing demand levels far exceeding original forecasts3. This sudden increase has caught the industry off guard, creating a scramble for available shipping space.

- Strike Threats: Potential strikes by the International Longshoremen's Association (ILA) in North America4 and Canadian rail workers5 have prompted many shippers to expedite their shipments, fearing disruptions.

These factors have created a scenario where demand far outweighs supply, leading to the market conditions we see emerging today. Vessel utilization from Asia-Pacific origins is currently +100%6. Accordingly, Peak Season Surcharges are going into effect early this year in an effort by carriers to bring fixed rates closer to the Freight All Kind (FAK) rate. Carriers are already starting to prioritize higher revenue shipments as demand is outpacing available capacity.

How Will Ocean Freight Shipping Rates Increase in the Coming Months?

Spot rates are continuing to increase, with General Rate Increases (GRIs) scheduled every two weeks through at least mid-June. A Peak Season Surcharge is expected to begin June 1. Carriers expect the rate hikes to stick in the short term as vessels leaving Asia are full well into June. An "Early Ocean Peak Season” is likely, extending these conditions for several months.

The chart above demonstrates how quickly rates can change in the industry. After several months of downward pressure on rates for the major East-West trades, rates have increased rapidly. Starting on May 1, carriers began implementing significant rate increases, with additional increases expected to continue throughout June.

Why Are So Many Ocean Containers Being Rolled?

Carriers traditionally often overbook vessels, expecting many shippers to book the same shipments with multiple carriers or NVOCCs to ensure shipments are loaded. This can mean last-minute cancellations may occur. Currently, shippers and NVOCCs are sailing their bookings rather than canceling, which is creating significant roll pools. Typically, rolled containers would be prioritized for the next sailing, but with the rapid rate increases, some containers may be rolled multiple times based on the rate at which they were booked.

What Can Your Business Prepare for an Early Ocean Shipping Peak Season?

It’s easy in times like this to panic, but the key to navigating the current market is to act intentionally.

- Book your shipments 4-6 weeks prior to your target ship date. Book on the UPS® Forwarding Hub early to set yourself up to get ahead of the roll pools, placing you in line for future sailings.

- Review your inventory and identify urgent shipments vs. shipments you can afford to hold for a few weeks.

- Fulfill booked volume. Ship the volume you have booked to avoid penalties (reduced future allocations).

- Consider alternative shipping methods for time-sensitive cargo.