This document is for informational purposes only. It does not constitute legal advice. Information herein was obtained from government, industry, and other public sources. It has not been independently verified by UPS and is subject to change. Recipient has sole responsibility for determining the usability of any information provided herein. Before recipient acts on the information, recipient should seek professional advice regarding its applicability to the recipient's specific circumstances.

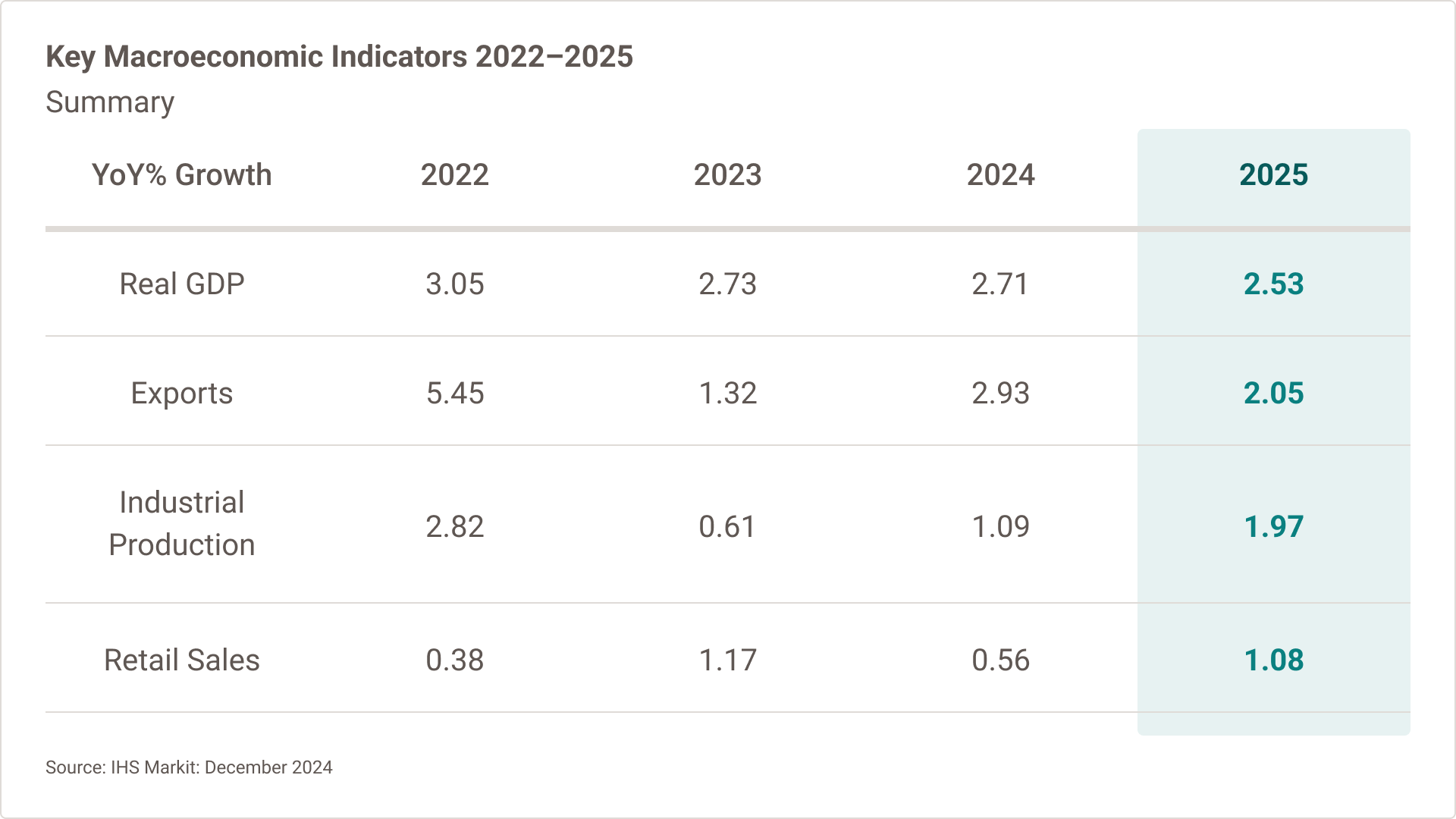

Global Macroeconomic Trends

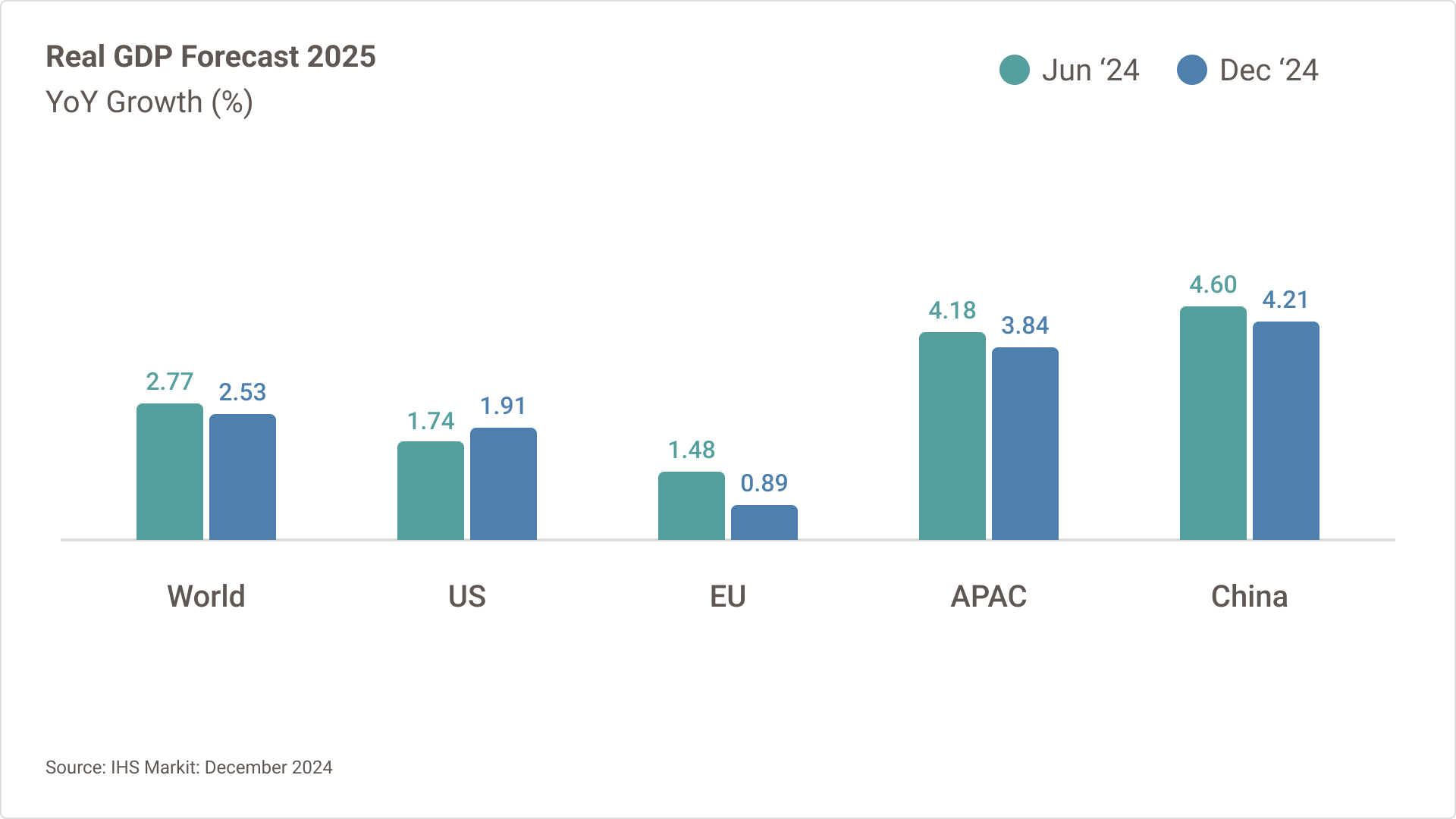

Global Macroeconomic forecasts have decreased, with weaker second-half GDP growth expected globally in 2025, while US projections have increased.

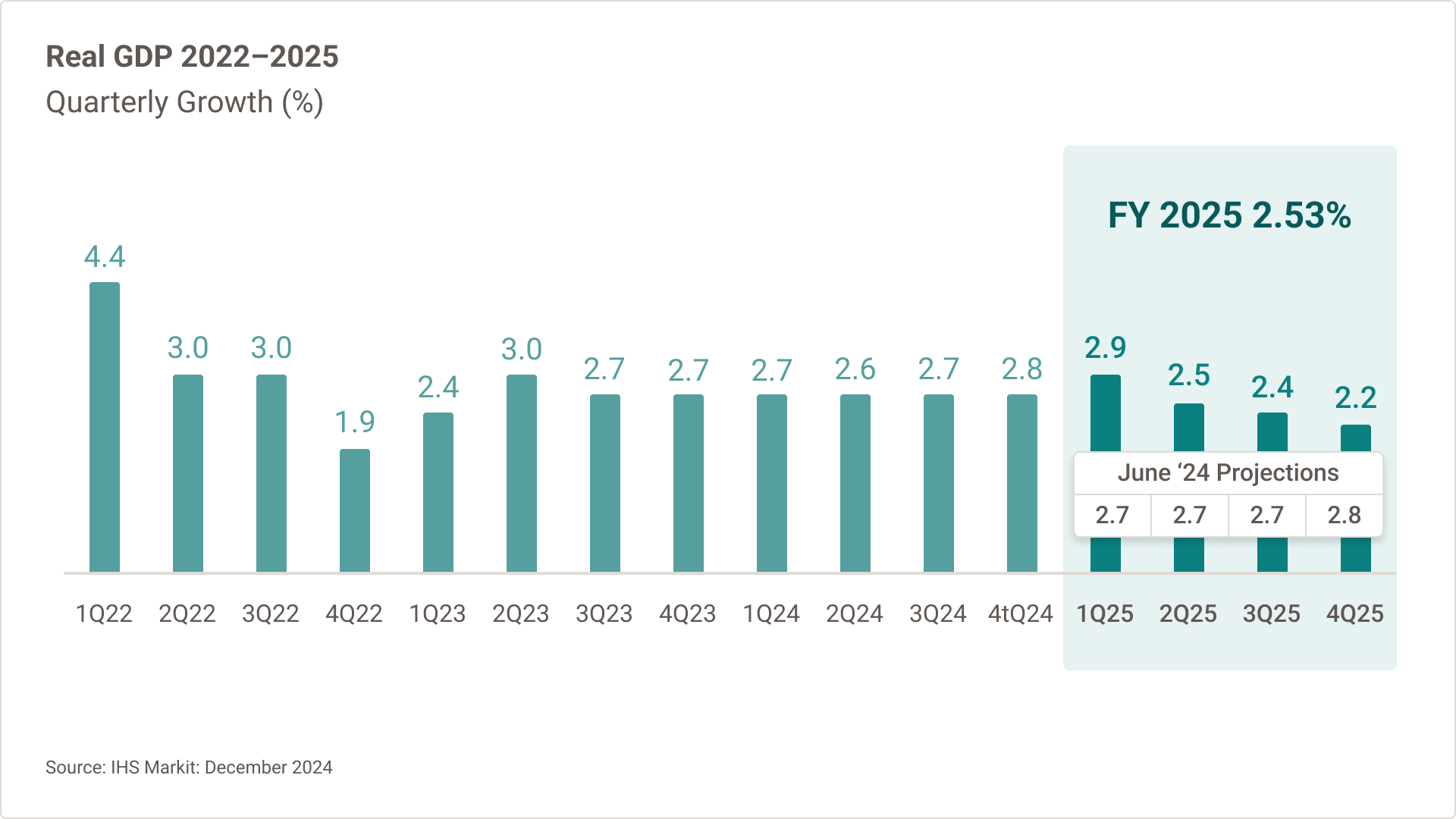

Real GDP Quarterly Growth 2022-2025

- Exports forecasts have been revised down to 2.05% globally, with Chinese exports decreasing over 7% and decreases from the US, Eurozone and APAC.

- Industrial Production forecasts have been revised down 1.97% globally, with significant contraction in Europe and decreases in the US, China and APAC.

- Retail Sales forecasts decreased with Europe, China and APAC declining.

Source: IHS Markit: December 2024

2025 Real GDP Forecast

- World GDP growth forecasts for 2025 have been revised down from 2.77% in June to 2.53% in December with a more positive US outlook.

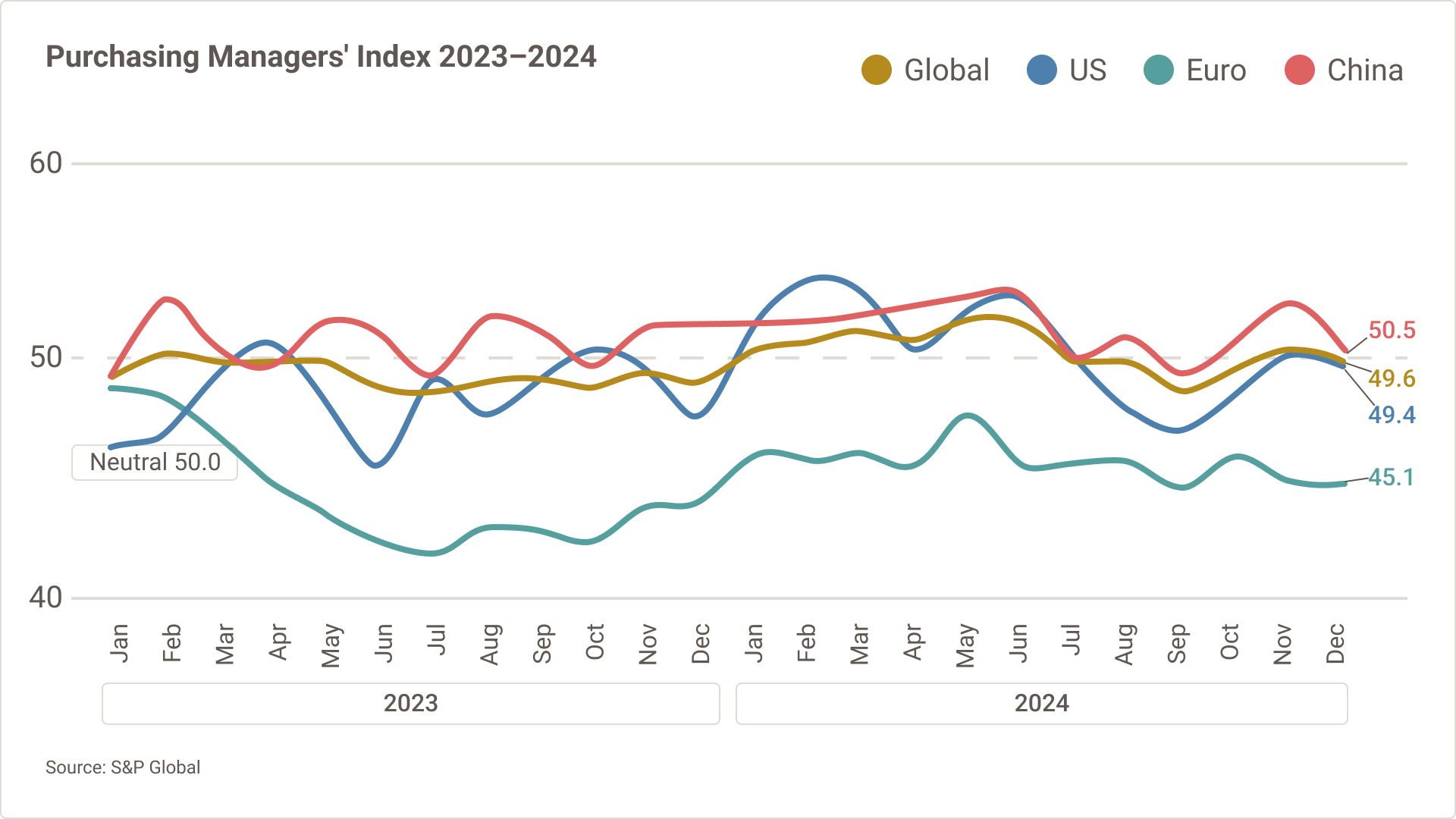

Purchasing Managers' Index (PMI)

- Global manufacturing PMI decreased slightly to 49.6 in December, down from a neutral 50.0 in November, with declines in both output and new orders.

- China’s manufacturing PMI fell to 50.5 in December, with new orders and output growth down from November and continued inflation of input costs.

- US manufacturing PMI ended 2024 with a decline, falling slightly to 49.4 with an overall drop in new orders and sharper declines in exports.

- Eurozone PMI fell to 45.1 in December, marking 30 months of contraction.

Source: S&P Global

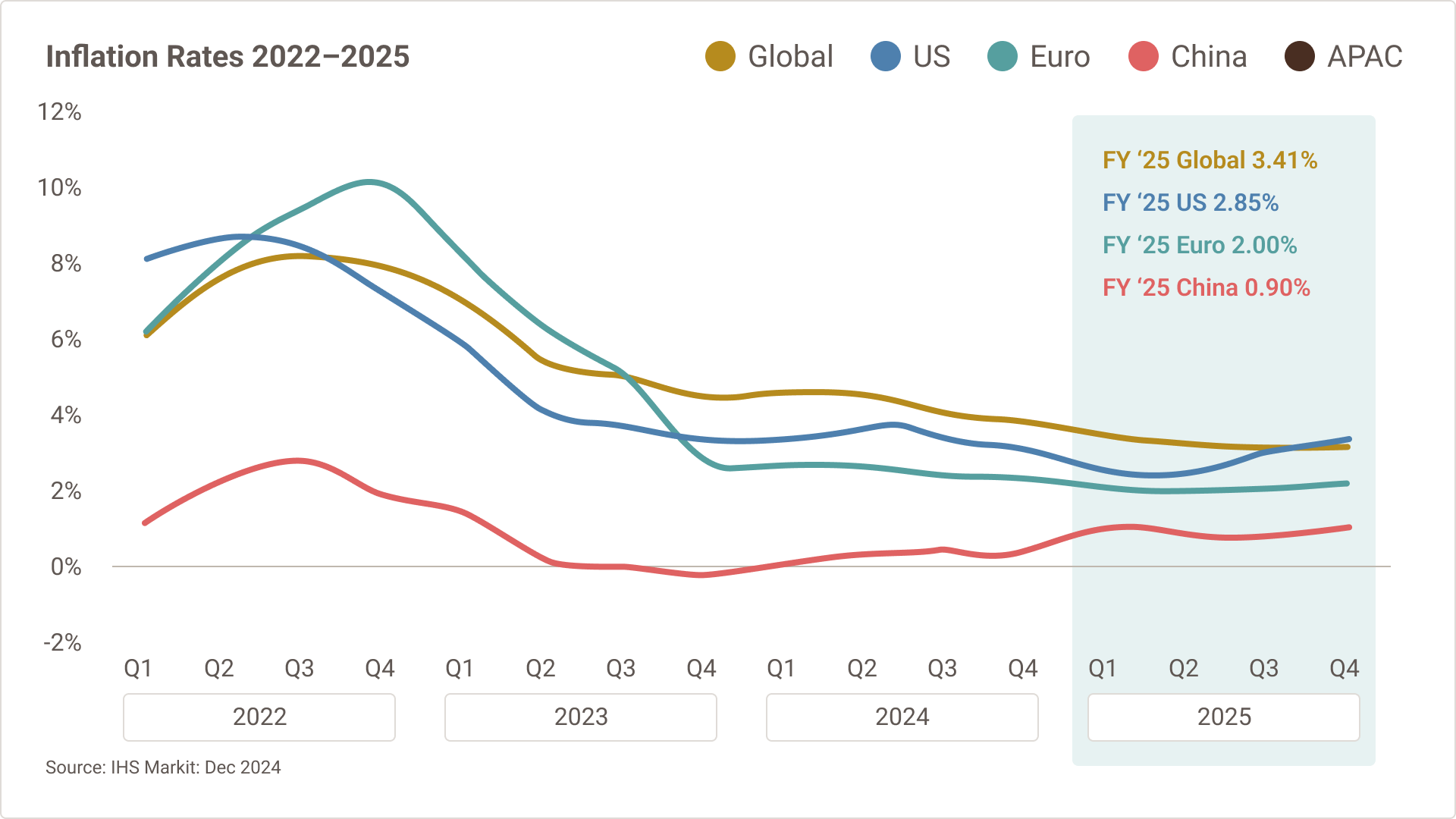

Quarterly Inflation Rate

- The global annual inflation rate has remained flat from June projections (3.37%) to December at 3.41%.

- Inflation rates in China saw a revision down from 1.7% to 0.9% for 2025, with higher inflation impacting the economy in Q4, well below June projections and significantly below global inflation rates.

- US inflation rate forecast increased to 2.85% in December, up from 2.36% in June, with higher inflation in 2H 2025.

Source: IHS Markit: Dec 2024

Air Freight Industry Update

2024 demand outpaced overall capacity growth, leading to increased global rates, with significant impacts on heavily trafficked eCommerce lanes.

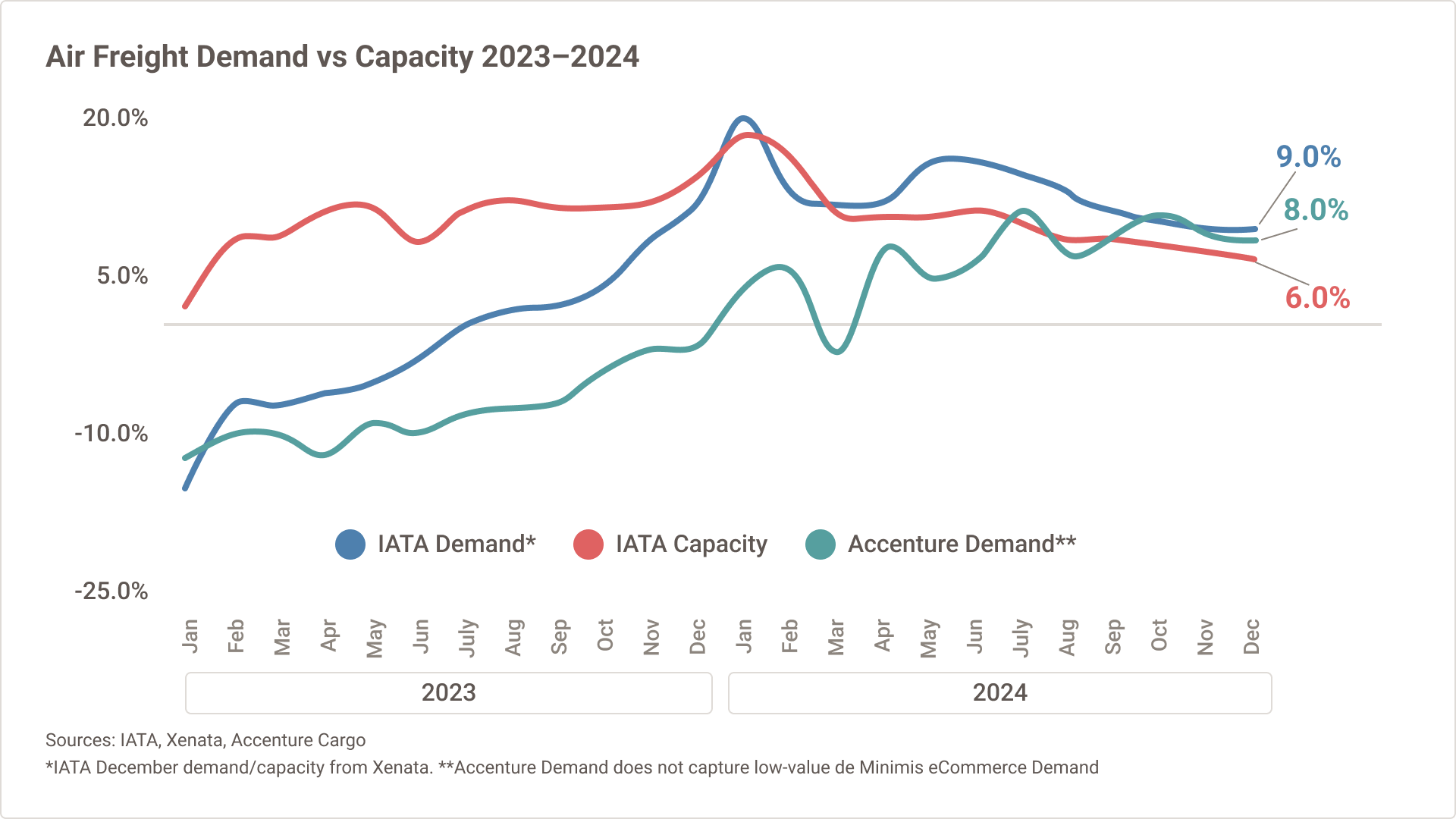

Air Freight Demand vs. Capacity

- Accenture projects full year 2024 air cargo demand growth at +5.7% with early 2025 forecasts down to +3.5%.

- IATA YTD (Jan-Nov) International Demand grew +12.7%, with available capacity lagging at +9.9% growth over the same period.

- IATA YTD (Jan-Nov) demand was led by APAC and Middle East demand growth at +15.2% and +14.0%, respectively.

Sources: IATA, Xenata, Accenture Cargo

*IATA December demand/capacity from Xenata

**Accenture Demand does not capture low-value de Minimis eCommerce Demand

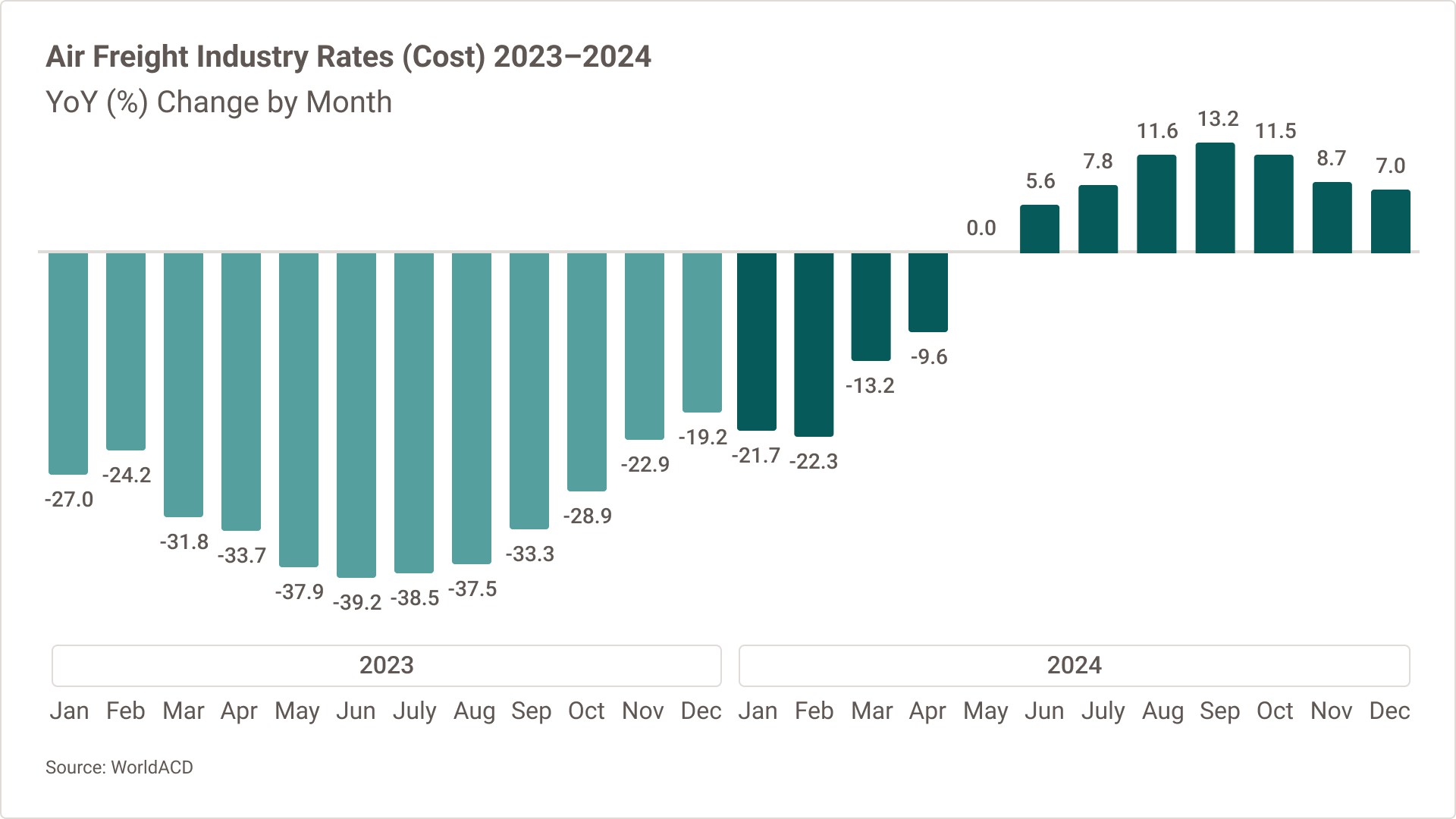

Air Freight Industry Rates

- APAC outbound demand has continued strong growth into the end of 2024, with Q4 tonnages up +11% from the previous year. Rates on APAC → US/EU destinations remain elevated and have contributed to average global rate increases.

- Demand is expected to continue outpacing capacity into 2025, likely continuing to elevate rates on heavily trafficked eCommerce lanes out of China, other APAC hubs and alternative production areas and shipping hubs in the Middle East and Indian subcontinent.

Source: WorldACD

Air Freight Industry Trends

The continued eCommerce demand boom will drive overall demand growth in 2025, though at a more muted level than 2024, while capacity again struggles to keep pace. Transportation carriers will have to adjust to meet their customers' supply chain needs.

Ocean Freight Industry Update

Continued demand growth compounded by fears of additional tariffs on China are driving rate increases in the Transpacific trade.

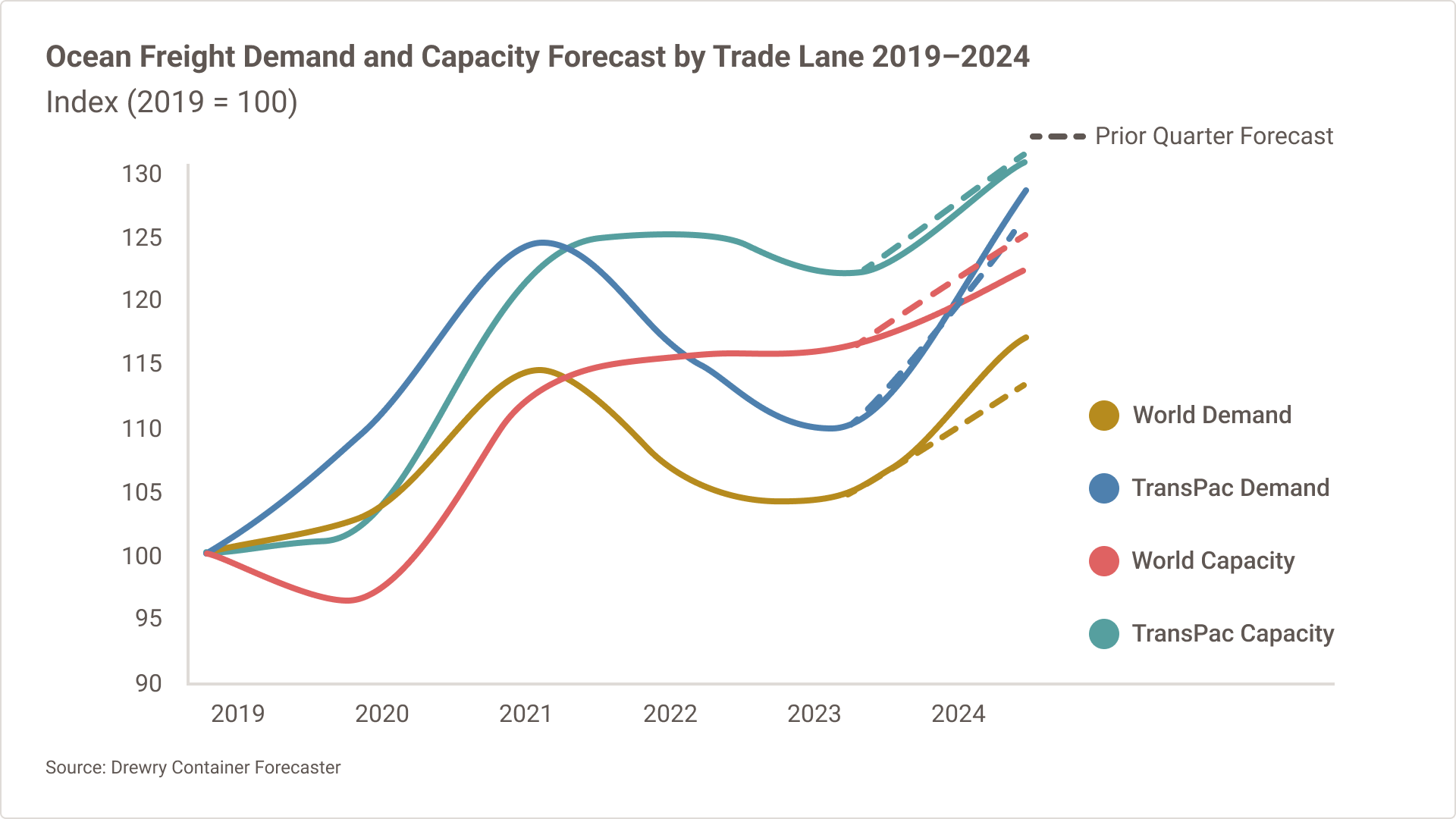

Demand vs. Capacity

- FY24 forecast for transpacific capacity reduced -0.4% QoQ, while FY24 transpacific demand forecast increased +3.5% QoQ.1

- Global Port Tracker’s US Import TEU forecasts for 1Q25 suggest continued strong demand in the Transpacific tradelane (+6.8% YoY).2

- Drewry has forecasted YoY global capacity growth of 4.9% in 2025. Despite the continued introduction of new capacity, rates are likely to remain elevated so long as carriers are forced to avoid the Red Sea.1

Sources: 1) Drewry Container Forecaster; 2) National Retail Federation

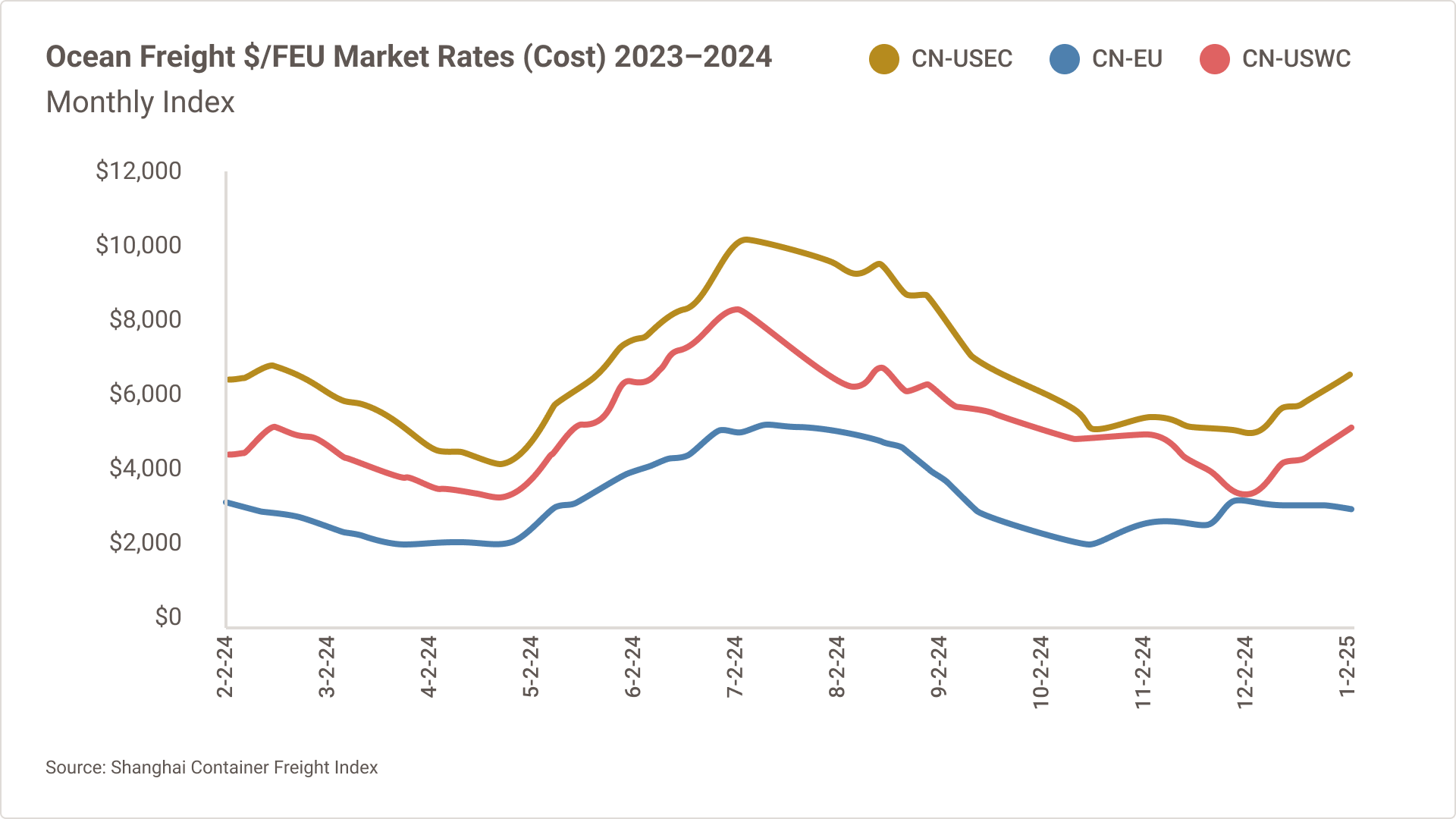

Rates

- Rates in the Transpacific trade lane rose by +28% in December due to increased demand driven by the upcoming Lunar New Year holiday on January 29, concerns over a potential ILA strike (which was averted on January 8), and fears of additional tariffs on goods originating from China.1

- Additional rate increases are expected throughout at least January with various GRIs, Port Congestion Surcharges, and other surcharges being proposed by the carriers.2

Sources: 1) Shanghai Container Freight Index; 2) Journal of Commerce

Ocean Freight Industry Drivers

Market outlook for 2025 is cloudy with geopolitical factors and a reshuffling of carrier alliances driving uncertainty. The ability to quickly implement a “Plan B” is critical in planning for 2025.

Customs & Trade Compliance Trends

Evolving Trade Policies and Tariff Updates: Impacts on Global Commerce

Global Logistics & Distribution Highlight

Contract logistics & warehousing continue to be in high demand.

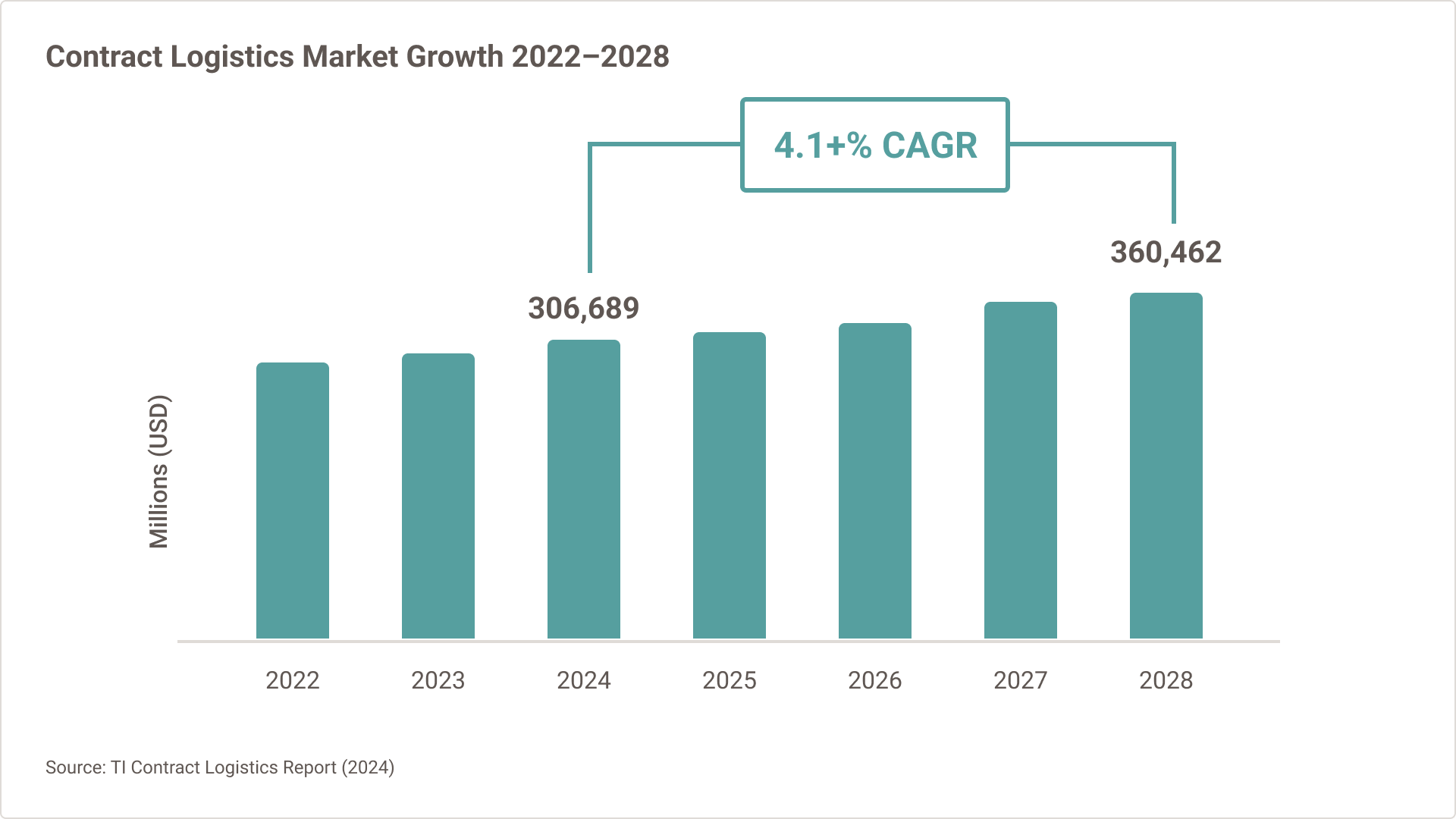

Global Contract Logistics to increase in 2025, growing by 4.3% YoY1

- Inflation is moving closer to central bank targets in major economies, though differences are starting to emerge.4

- Progress in reducing inflation has stalled in the US, with recent sequential inflation readings showing no significant change. Services inflation, in particular, remains high.4

- Contract logistics market continues to outpace global GDP (2024-2025 YoY 3.2%).2

- Implications: Steady increase in consumer spending due to lower interest rates and decreased inflation.

Sources: 1)TI Contract Logistics Report (2024), 2) IMF , 4) S&P Global

Continued Regionalization of Supply Chains

- Recent events have shown that complex, dispersed supply chains are vulnerable to disruptions, highlighting the appeal of reconnecting with domestic and regional supply chains.1

- Similar to the US, China is working on a $144B support package for its semiconductor industry, and Europe is likely to follow with similar projects.1

- Implications: While demand for logistics outsourcing is expected to increase, carriers will diversify their supply chain solutions to mitigate risk.

Source: 1)TI Contract Logistics Report (2024)

Market Trends

- Adaptation of automation and robotics in warehousing is expected to accelerate.3

- In a recent Ti survey, the majority of respondents highlighted that eCommerce accounts for between 41-50% of total contract logistics volumes.1

- Implications: With the increasing demand for eCommerce, optimizing systems to maximize space and reduce operating costs will be crucial.3

Sources: 1)TI Contract Logistics Report (2024), 3) WA

More From UPS Supply Chain Solutions

UPS Freight Services

At UPS SCS, we’re here to simplify shipping freight. Find the freight service that’s right for you and get your freight moving in the UPS Forwarding Hub.

Explore Freight Services

Latest News

Read the latest freight and logistics news and market updates from the world of supply chain.

Read the Latest News

Ask an Expert

Questions? We’ll connect you to people with answers. Tell us about you, and choose a topic to get started.

Contact Us